SRINAGAR: At a time when Kashmir’s internationally acclaimed handicraft sector is grappling with falling exports and the menace of machine-made imitations, the Goods and Services Tax (GST) Council’s decision to slash GST on handicrafts from 12 per cent to 5 per cent has come as a rare ray of hope for artisans and traders. The Valley’s artisans, numbering over 3.71 lakh, have described the move as a “lifeline” for a centuries-old craft that has been struggling to survive.

Though artisans were not directly paying GST, dealers and exporters—who buy and market handicrafts—had to deposit 12 percent upfront.

This blocked their working capital until the products were sold, discouraging bulk purchases and slowing down payments to artisans. With the new GST rate of 5 percent, traders believe liquidity will improve and sales will pick up, ensuring artisans are not left waiting endlessly for dues.

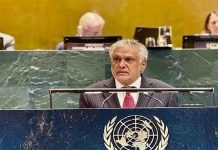

The Directorate of Handicrafts and Handloom Kashmir welcomed the move in a social media post. “A big thank you to #GSTCouncil for REDUCING GST on handicrafts from 12% to 5%. This has come as an elixir for the artisan community who have given their sweat and blood to keep #Kashmir’s craft heritage ALIVE,” the department wrote.

For artisans, the tax cut brings cautious optimism. Ghulam Rasool, a carpet weaver from Budgam, said the reduced levy will have a direct impact on his livelihood. “When dealers had to pay 12 percent GST, they would buy less from us and hold back payments. Now they will be more willing to stock carpets and shawls, which means we might finally see faster returns for our work. This is not just about tax—it is about respect for our craft,” he said.

Another artisan, Muhammad Jaffar, who specialises in papier-mâché, said demand for products had sharply fallen in recent years.

“Middlemen often tell us they cannot afford to keep our work because of high costs and poor sales. If the tax cut helps them buy more, maybe our craft will see revival,” she remarked.

Data paints a worrying picture. Kashmir’s handicraft exports have been steadily declining, dipping to just around Rs 700 crore in the last financial year, compared to over Rs 1,700 crore a decade ago. Rising raw material costs, lack of modern marketing, global recessionary trends, and heavy competition from machine-made substitutes have all combined to shrink the Valley’s once-thriving export sector.

Exporters say price sensitivity is one of the biggest challenges in retaining buyers. “Even a small increase in cost pushes buyers toward alternatives,” said a Srinagar-based exporter, requesting anonymity. “The earlier 12 percent GST made Kashmiri products expensive and uncompetitive. With 5 percent, we can at least quote better prices.”

Adding to the crisis is the flood of machine-made items being passed off as “Kashmiri handicrafts” in domestic and international markets. Machine-embroidered shawls, imitation carpets, and factory-made papier-mâché products are sold cheaply but labeled as Kashmiri, eating into the genuine craft’s market share.

“Customers in Delhi, Mumbai, or even Dubai are often duped into buying power-loom or machine-made goods marketed as Kashmiri handcrafts. This not only robs artisans of income but also destroys the brand value of our heritage,” said Abdul Hamid, a walnut woodcarver from downtown Srinagar.

Read more: South Kashmir Floods Ravage Paddy, Apple Crops